Our AI-Powered Business Solutions

At Terrix Group, we leverage cutting-edge AI technology to optimize every aspect of our investment services, delivering superior results, enhanced profits, and safer investments.

AI Trading

Our discrete proven AI strategy analyzes crypto, stock, and forex markets with expert precision. Advanced machine learning algorithms process vast amounts of market data in real-time, identifying profitable opportunities and executing trades with unprecedented accuracy.

Equities Excellence

Equities are a popular investment for good reason – but as times change, so does the way you need to invest. Our AI algorithms adapt to market conditions, analyzing company fundamentals, market sentiment, and economic indicators to optimize your equity portfolio performance.

Fixed Income Intelligence

Bonds are perceived as being lower risk – but fixed income strategies need specialist knowledge to shine. Our AI systems analyze yield curves, credit spreads, and macroeconomic factors to maximize returns while preserving capital in bond investments.

Multi-Asset Mastery

Go for the best of all worlds by combining different assets. Our AI-driven multi-asset strategies dynamically allocate between stocks, bonds, commodities, and alternative investments based on market conditions and risk-return optimization.

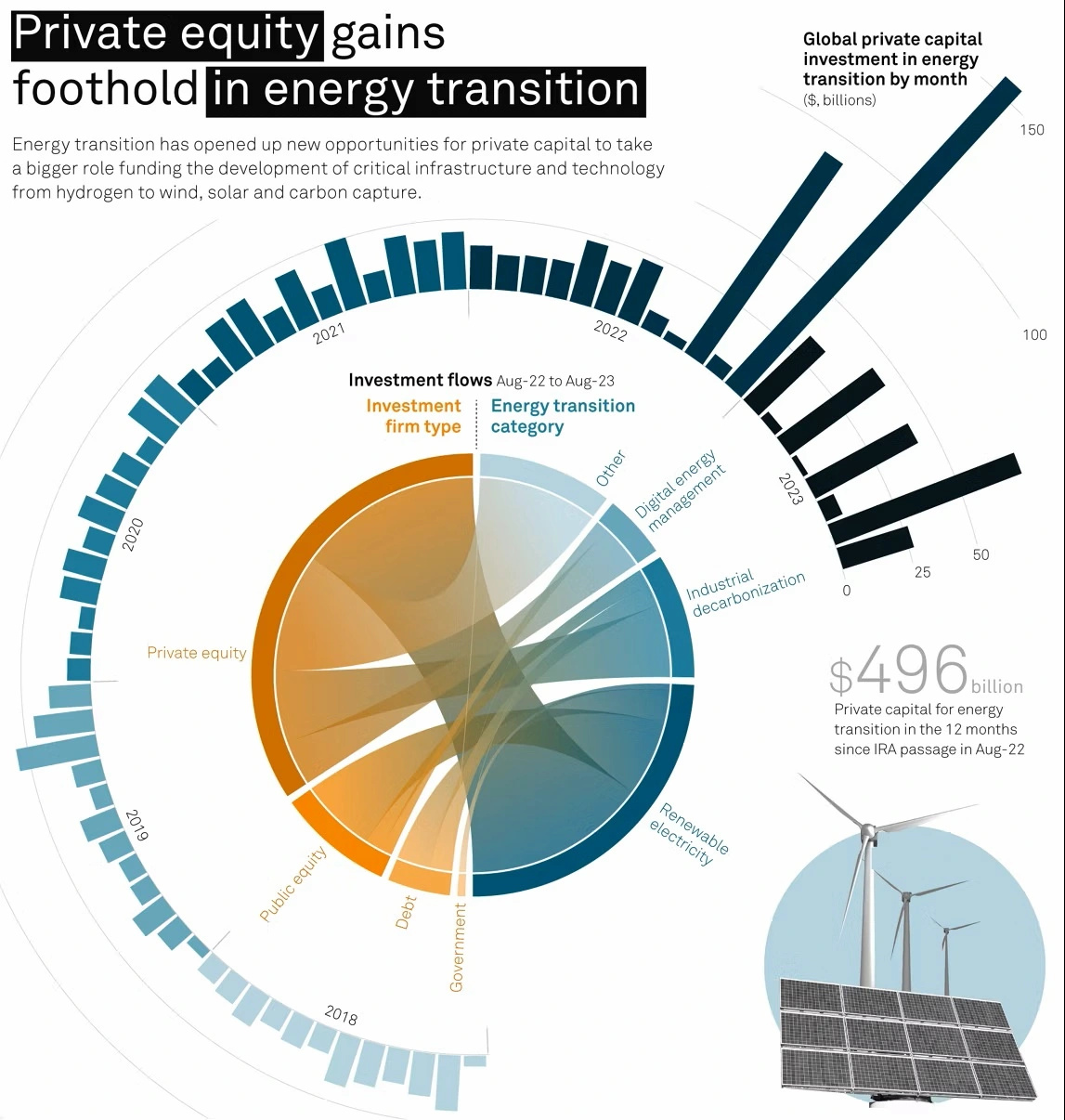

Energy Transition Investment

The need to decarbonize is accelerating the energy transition globally. Our AI algorithms identify the most promising opportunities in renewable energy, clean technology, and sustainable infrastructure investments.

From solar and wind energy projects to electric vehicle infrastructure and energy storage solutions, our AI-powered analysis helps you capitalize on the trillion-dollar shift toward a sustainable future.

- Renewable Energy Projects

- Clean Technology Investments

- Sustainable Infrastructure

- Carbon Credit Trading

The Technology Behind Superior Results

AI Trading: Precision Meets Profit

Our AI trading systems utilize advanced machine learning algorithms, natural language processing, and predictive analytics to:

- Market Analysis: Process thousands of data points per second including price movements, volume patterns, news sentiment, and economic indicators.

- Pattern Recognition: Identify profitable trading patterns that human traders might miss, across crypto, forex, and stock markets simultaneously.

- Risk Management: Automatically adjust position sizes and implement stop-losses based on real-time volatility analysis.

- Execution Speed: Execute trades in milliseconds, capitalizing on fleeting market opportunities.

Equities: AI-Enhanced Stock Selection

Our equity investment approach combines fundamental analysis with AI-powered insights:

- Fundamental Analysis: AI evaluates financial statements, earnings reports, and company metrics at scale.

- Sentiment Analysis: Monitor social media, news, and analyst reports to gauge market sentiment.

- Sector Rotation: Identify optimal timing for sector allocation based on economic cycles and market conditions.

- ESG Integration: Factor in Environmental, Social, and Governance criteria for sustainable investing.

Fixed Income: Intelligent Bond Strategies

Our AI-driven fixed income strategies optimize bond portfolios through:

- Yield Optimization: Identify bonds offering the best risk-adjusted returns across different maturities and credit qualities.

- Duration Management: Dynamically adjust portfolio duration based on interest rate forecasts and economic conditions.

- Credit Analysis: AI-powered credit risk assessment to avoid defaults and identify upgrade opportunities.

- Liquidity Management: Ensure optimal liquidity while maximizing yield through intelligent bond selection.

Multi-Asset: Diversification Perfected

Our multi-asset approach uses AI to create perfectly balanced portfolios:

- Dynamic Allocation: Continuously adjust asset allocation based on market conditions, risk levels, and return expectations.

- Correlation Analysis: Monitor asset correlations in real-time to maintain true diversification benefits.

- Alternative Assets: Include commodities, REITs, and other alternatives for enhanced diversification.

- Risk Parity: Balance risk contribution across assets rather than just capital allocation.